|

Anthony R. Blansett | President

Anthony Blansett graduated with a BA in Economics from the University of Redlands located in Southern California. While attending college, he participated in four years of NCAA football and was an active member of one of the school's charter fraternities. He later completed his first Masters degree while serving on active duty as a commissioned officer and pilot with the U.S. Marine Corps.

Anthony specializes in risk-free asset management, IRA/401k conversion strategies and retirement income planning. He is particularly focused on helping clients mitigate the severe impact of taxes on qualified retirement plans, Social Security income and the cost of Medicare premiums. Proper planning with qualified retirement accounts can dramatically reduce income taxes, preserve your Social Security and minimize the cost of Medicare premiums. He has completed the Certified Retirement Financial Advisor (CRFA) curriculum, which is an advanced designation for experienced advisors who focus on retirees’ unique financial and estate planning needs. He is currently completing the Master of Science for Financial Services (MSFS) program through the Institute of Business and Finance (IBF). The MSFS consists of board certifications in estate planning, taxes, retirement income planning, annuities and mutual funds. While there is no financial regulatory requirement to complete this particular curriculum, the MSFS through the IBF was selected as the best platform to enhance the scope of services provided by Blansett Wealth Navigation. Anthony lives in Boise’s Harris Ranch. In his free time, he enjoys skiing, sailing and hiking with his dog, Tupelo. He has one daughter who graduated from Boise High School, earned her bachelor’s degree from UC Berkeley, her master’s degree from UC Santa Barbara and is currently working as a consulting arborist in Denver. |

|

Our Services

What We Do For Clients We offer a group of services that is both unique and extremely valuable with respect to your retirement goals. Selected services are utilized as needed, to customize a plan that addresses: asset protection; income planning; tax-minimization; medical and long term care costs; and legacy/estate planning.

|

1. Asset Protection / Retirement Income Planning

|

We specialize in helping retirees protect their retirement assets, while continuing to move forward. Traditionally, if you wanted to achieve strong gains, you had to incur higher risk. And if you wanted more safety, you had to accept very low rates of return. That is no longer the case. Now you can give yourself the opportunity for higher gains, without any of the usual risk. Contact our office to learn about newer alternatives that are perfect for today's volatile environment.

Having worked your whole life to build your retirement assets, it is critical to implement the right plan, to support your desired standard of living - for as long as you live. All available assets should be structured within the context of a fail-safe plan, that provides for: growth, flexibility and guarantees. Watch this quick video, to learn about our approach, to retirement income strategies. |

|

|

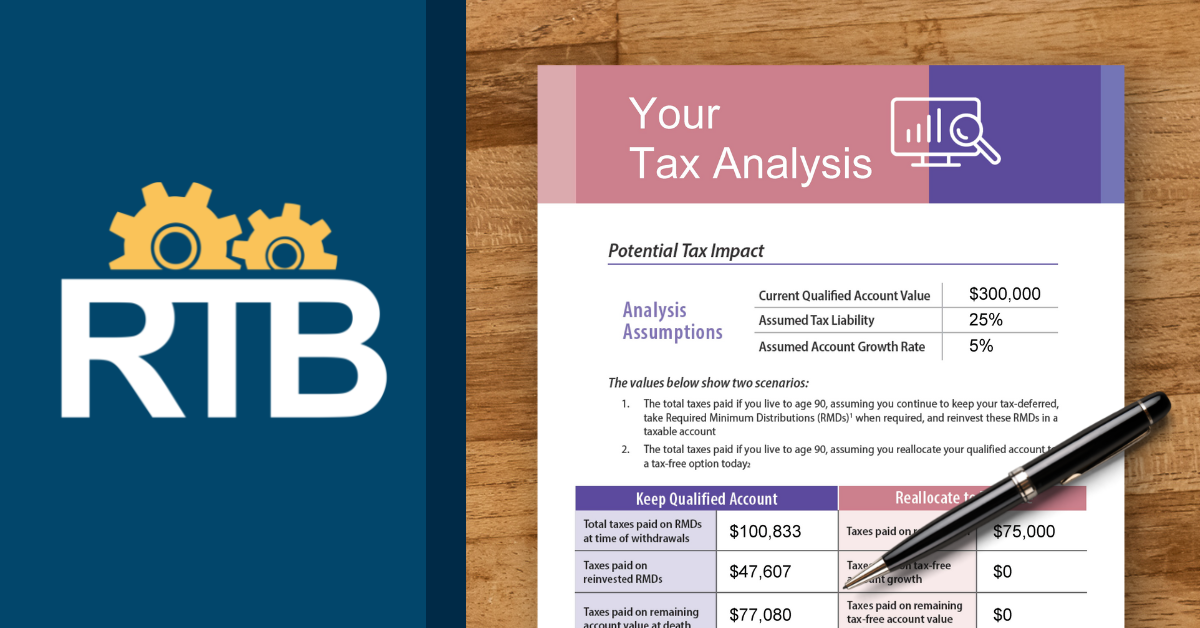

2. IRA/401k Rollover and Tax Reduction Strategies

Most people don't realize it, but the greatest danger to your retirement assets is not market volatility. It's actually the long term impact of state and federal taxes on your largest qualified accounts, i.e. IRAs, 401k's, 403b's etc. Use our Retirement Tax Bill calculator, to see and better understand your potential tax bill in retirement. Then call to discuss and learn how a few simple steps can reduce your tax liability - significantly.

|

Retirement Tax Bill Calculator

|

3. IRMAA and Medical/Long Term Care (LTC) Costs

It goes without saying that medical and LTC costs continue to rise substantially. However, directly related to the increasing cost of care, is the potentially increasing cost of your Medicare premiums. Based on newer government income brackets (IRMAA), the higher your taxable income in retirement, the higher the cost of your Medicare premiums - which in turn can directly impact your Social Security payments.

Therefore a strategy to address the increasing costs of care and premiums, should be front and center in any retirement plan. Call us to learn how we can illustrate these projected Medicare premium costs, the impact on your SS payments and options to address the problem.

Therefore a strategy to address the increasing costs of care and premiums, should be front and center in any retirement plan. Call us to learn how we can illustrate these projected Medicare premium costs, the impact on your SS payments and options to address the problem.

4. Kaizen and the Power of Leveraging for Retirement Saving

Kaizen is a one of a kind retirement planning strategy, that utilizes the power of leveraged financing, to give you far greater tax-free income in retirement, than you could ever achieve with typical qualified retirement plans, i.e. IRAs, 401ks, 403bs, etc. This plan is ideal for those who are high income earners, but may feel that they're behind in their savings plan and/or want to make sure that they'll be able to retain their same standard of living in retirement.

Contact our office directly, for additional information and access to the ILIA planning software - to help you see exactly what you can accomplish with leveraging. Not only can it display side by side comparisons to other retirement plans, but you can run any number of scenarios, to determine your best savings strategy.

Contact our office directly, for additional information and access to the ILIA planning software - to help you see exactly what you can accomplish with leveraging. Not only can it display side by side comparisons to other retirement plans, but you can run any number of scenarios, to determine your best savings strategy.

5. Learning and Resource Center

Do you have questions about different types of mutual funds, bonds, life insurance and/or annuities? Not sure about the impact of taxes on your retirement savings and/or estate plans? Click on the Retire Village link, for access to our library of articles, videos and downloadable resources - to find the info and answers you need.

Once you have opened the Learning and Resource Center, you can also register for our twice-monthly newsletter, which is sent directly to your inbox, at no cost or obligation - just helpful information. And you can opt out at any time, if desired. Click the image below to access our free informational resources.

Once you have opened the Learning and Resource Center, you can also register for our twice-monthly newsletter, which is sent directly to your inbox, at no cost or obligation - just helpful information. And you can opt out at any time, if desired. Click the image below to access our free informational resources.